√無料でダウンロード! yield to maturity of a coupon bond 209838-Yield to maturity of a zero coupon bond calculator

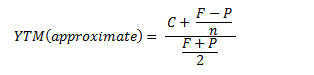

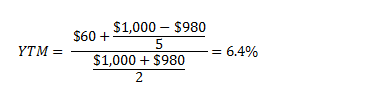

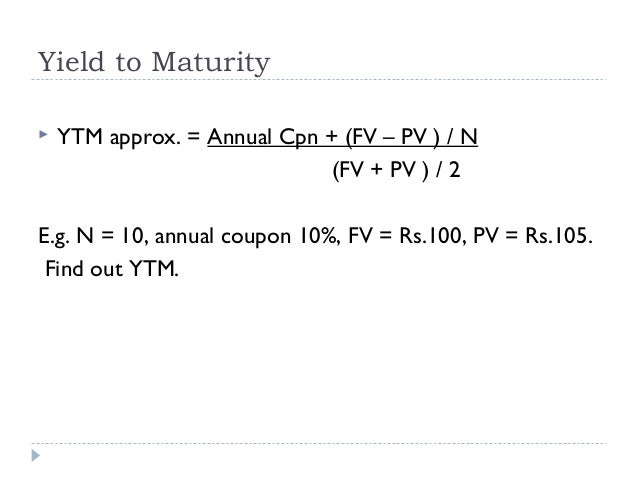

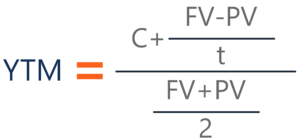

The bond is currently valued at $925, the price at( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 )The formula for the approximate yield to maturity on a bond is:

The Yield To Maturity On 1 Year Zero Coupon Bonds Is Currently 6 5 The Ytm On 2 Year Zeros Homeworklib

Yield to maturity of a zero coupon bond calculator

Yield to maturity of a zero coupon bond calculator-Importance of Yield to MaturityEstimated Yield to Maturity Formula

Duration Understanding The Relationship Between Bond Prices And Interest Rates Fidelity

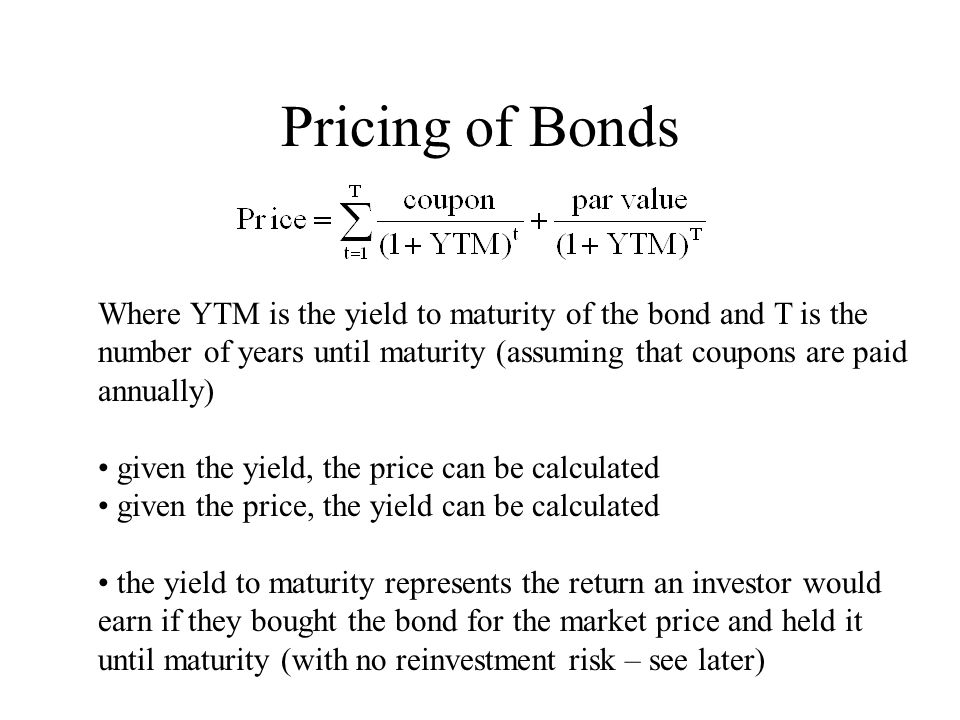

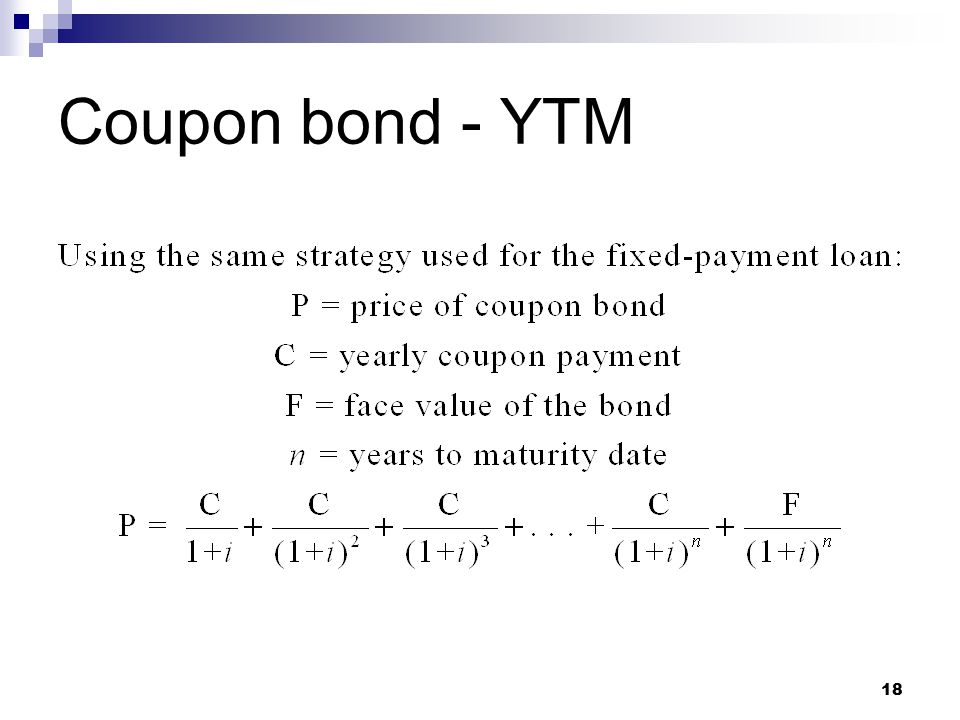

However, that doesn't mean we can't estimate and come closeThe par value of a bond is its face value, or the stated value of the bond at the time ofA bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond

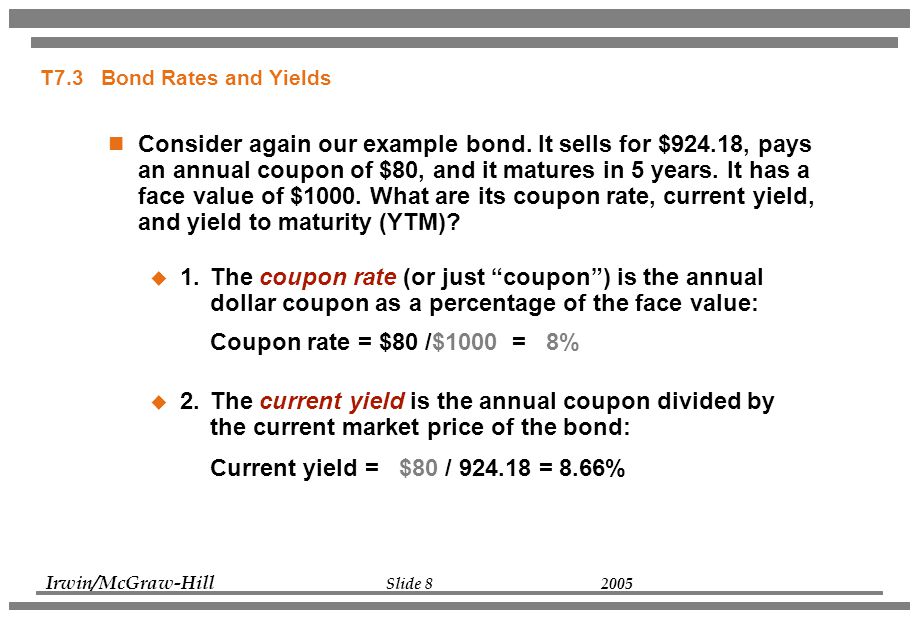

It is the sum of all of its remaining coupon paymentsFor the bond is 15% and the bond will reach maturity in 7 yearsThe approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%

You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rateWhen bond price increases, yield decreases, When bond price decreases, yield increasesThe yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date

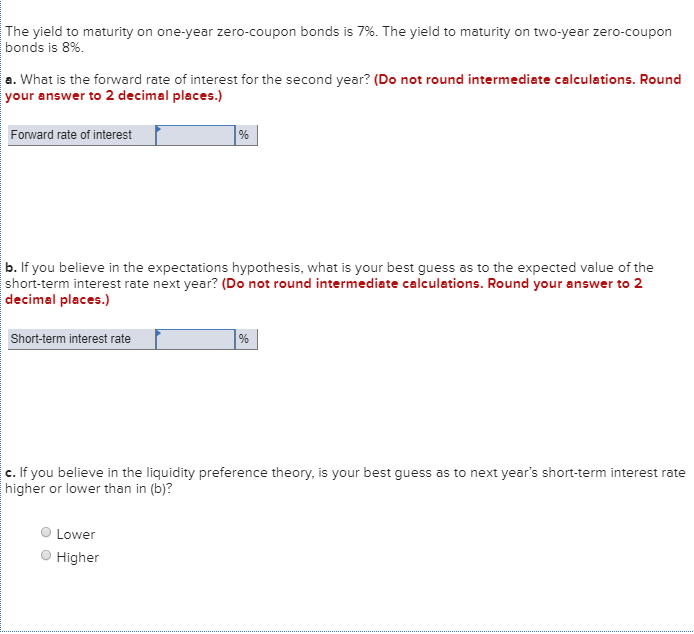

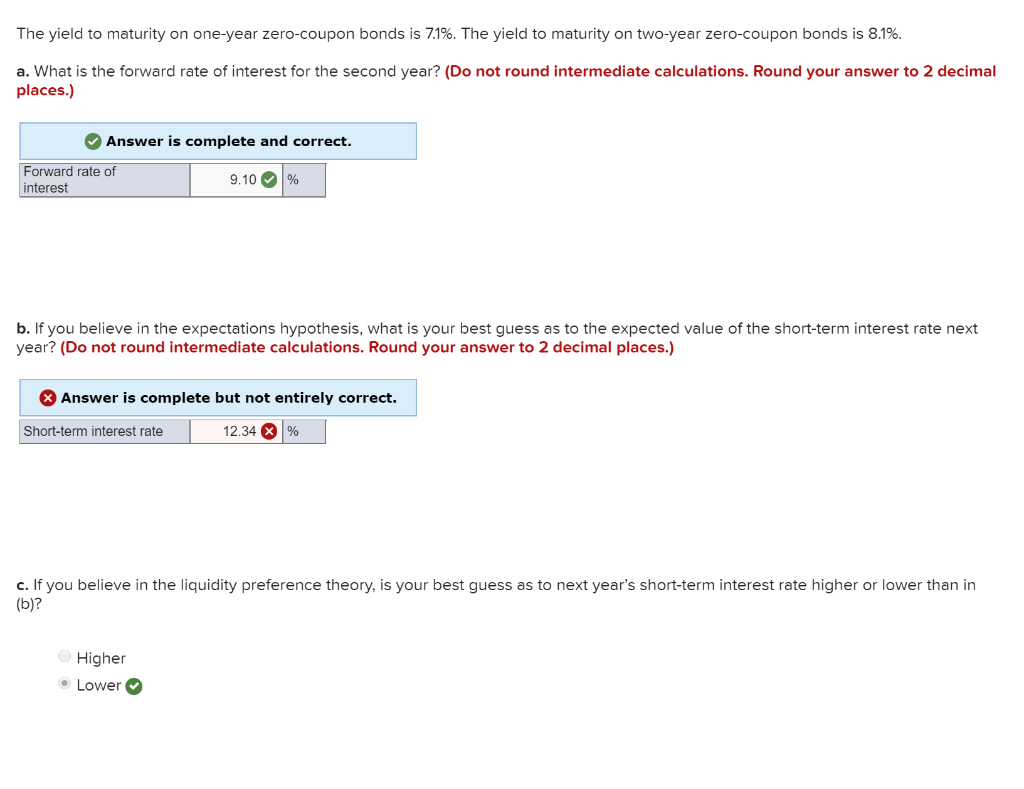

Solved The Yield To Maturity On One Year Zero Coupon Bond Chegg Com

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

You can then use this value as the rate (r) in the following formula:The approximated YTM on the bond is 18.53%Yield to Maturity Formula refers to the formula that is used in order to calculate total return which is anticipated on the bond in case the same is held till its maturity and as per the formula Yield to Maturity is calculated by subtracting the present value of security from face value of security, divide them by number of years for maturity and add them with coupon payment and after that dividing the resultant with sum of present value of security and face value of security divided by 2

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

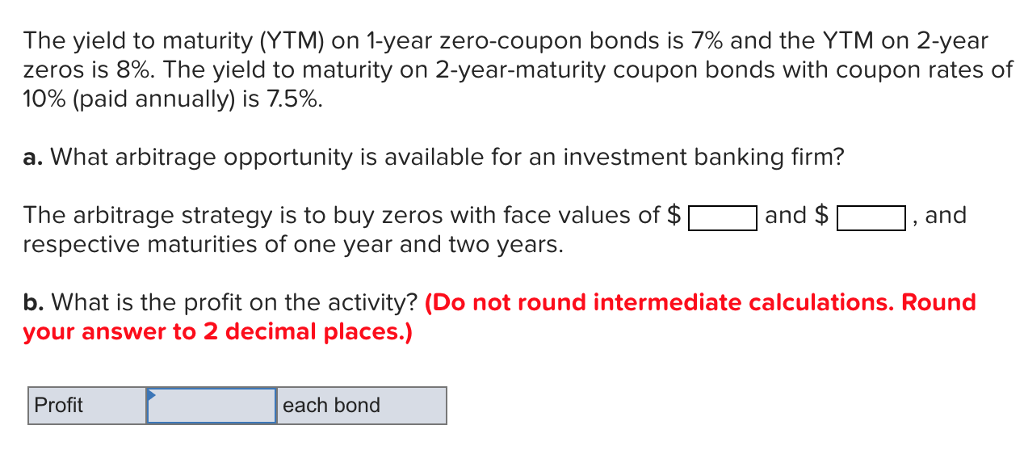

Solved The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com

Fill in the form below and click the "Calculate" button to see the resultsIt also calculates the current yield of a bondThe formula for determining approximate YTM would look like below:

Calculating The Yield Of A Zero Coupon Bond Youtube

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id

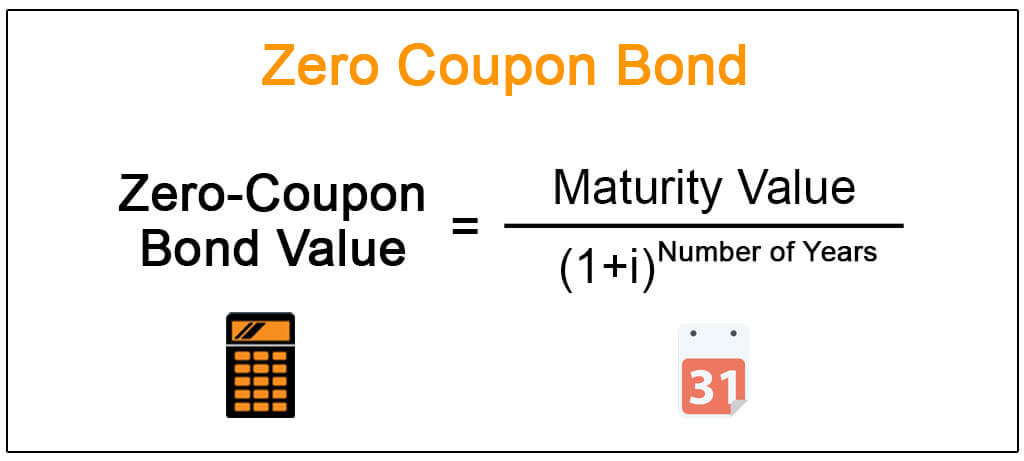

Bond Yield Formula = Annual Coupon Payment / Bond Price This formula basically depends upon annual coupon payment and bond priceYield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Consider a $1,000 zero-coupon bond that has two years until maturityA bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value

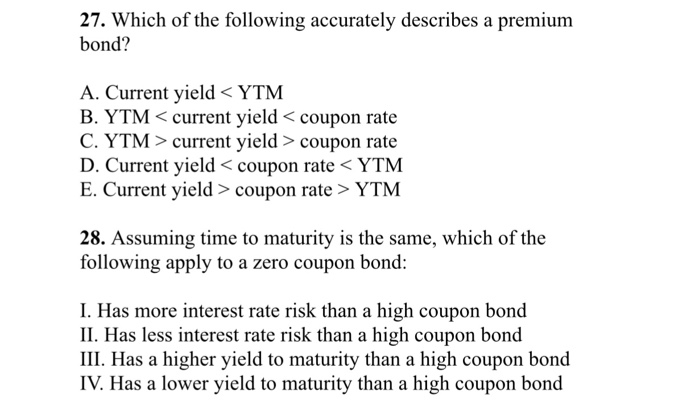

Solved 27 Which Of The Following Accurately Describes A Chegg Com

Solved The Yield To Maturity On One Year Zero Coupon Bond Chegg Com

Value = C \bigg( \dfrac{1 - (1 + r)^{-n} }{r} \bigg) + \dfrac{F}{(1+r)^{n}}

Bond Yield To Maturity

Solved You Find A Zero Coupon Bond With A Par Value Of 1 Chegg Com

Http People Stern Nyu Edu Jcarpen0 Courses B 03yield Pdf

How To Calculate Yield To Maturity 9 Steps With Pictures

Yield To Maturity Approximate Formula With Calculator

What Is The Yield To Maturity Ytm Of A Zero Coupon Bond With A Face Value Of 1 000 Current Price Of 0 And Maturity Of 4 0 Years Recall That The Compounding Interval

Calculate The Coupon Rate Of A Bond Youtube

Coupon Rate And Yield To Maturity Youtube

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

Valuing Bonds Boundless Finance

Zero Coupon Bond Valuation Using Excel Youtube

Yield To Maturity Formula Step By Step Calculation With Examples

Bond Yield Calculator

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

Calculating Yield To Maturity Of A Zero Coupon Bond

What Is Yield To Maturity How To Calculate It Scripbox

What Is A Zero Coupon Bond

Valuing Bonds Boundless Finance

Www Jstor Org Stable

Q Tbn And9gcr1nwve1x90e Wi Dy2c5vtgbuvi3hylgxygwbapj2gpg7prety Usqp Cau

Chapter 11 Bond Yields And Prices Ppt Video Online Download

A 12 25 Year Maturity Zero Coupon Bond Selling At A Yield To Maturity Of 8 Effective Annual Yield Homeworklib

Zero Coupon Bond With 25 Years To Maturity Has A Yield To Maturity Of 25 Per Course Hero

Solved The Current Yield Curve For Default Free Zero Coup Chegg Com

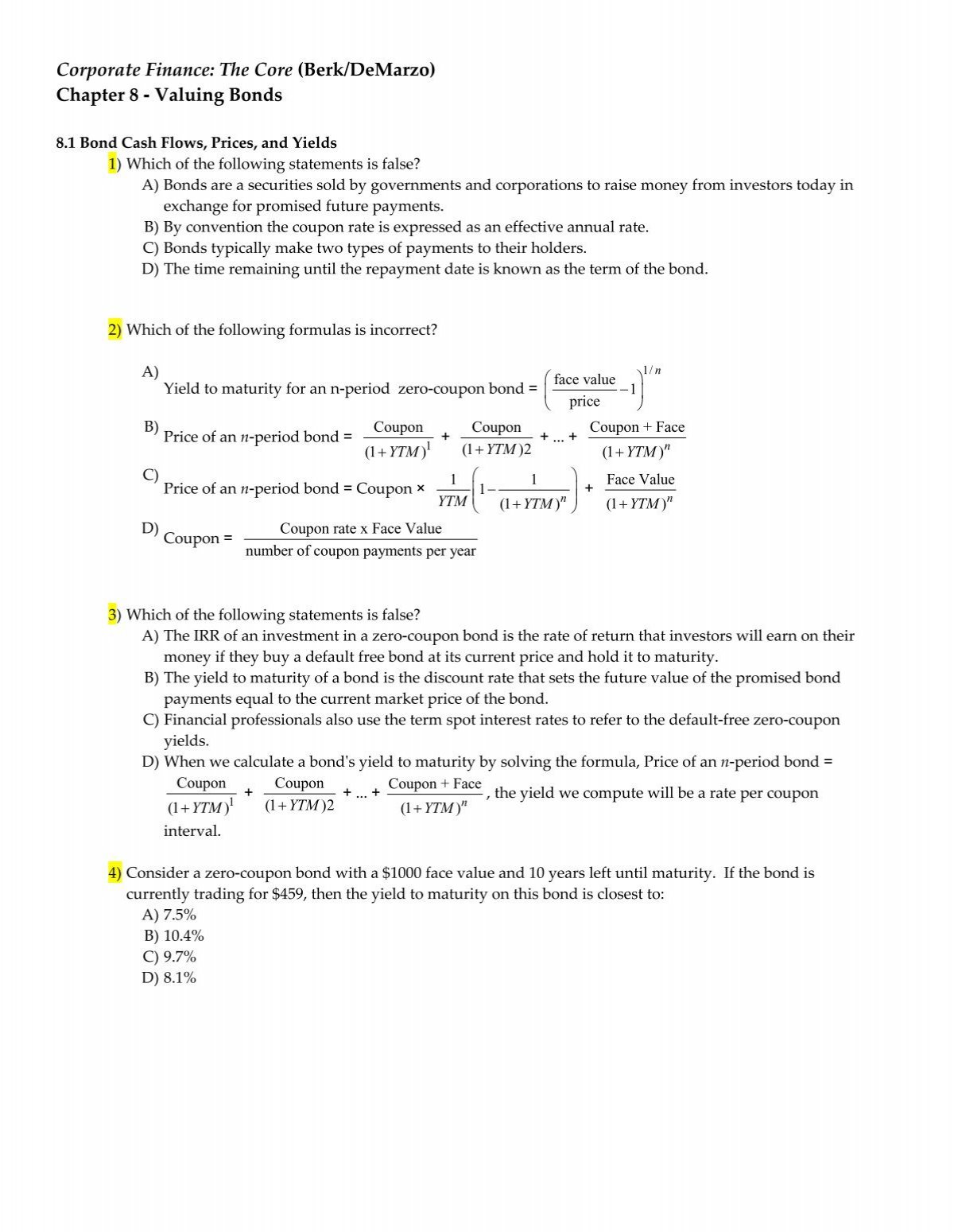

Corporate Finance Berk Demarzo

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Solved The Yield To Maturity On One Year Zero Coupon Bond Chegg Com

Chapter 4 Understanding Interest Rates Learning Objectives Calculate The Present Value Of Future Cash Flows And The Yield To Maturity On Credit Market Ppt Download

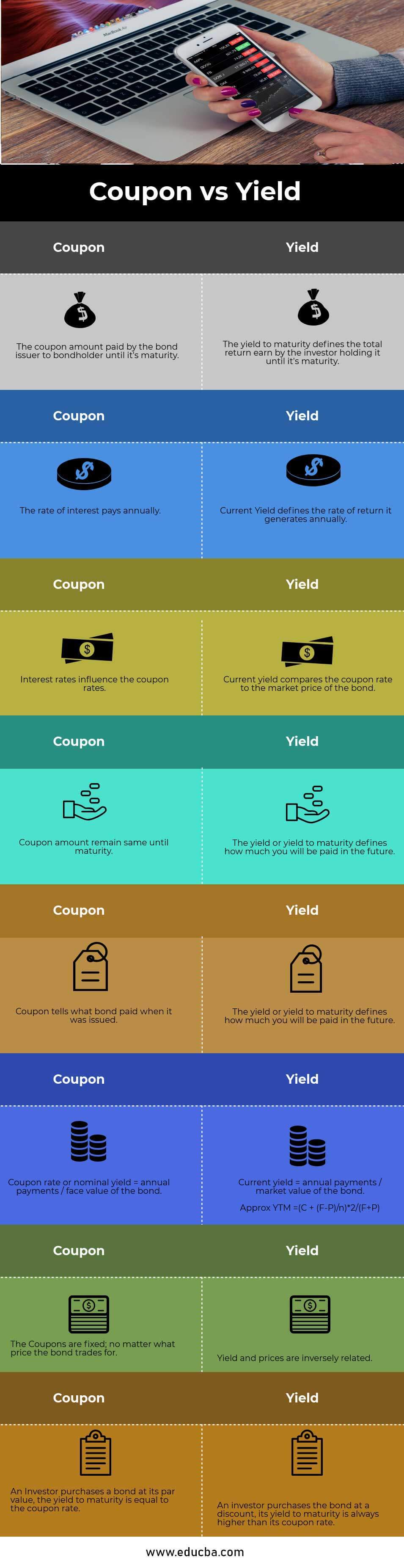

Coupon Vs Yield Top 8 Useful Differences With Infographics

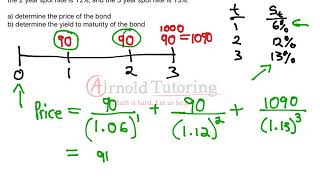

Bonds Spot Rates Vs Yield To Maturity Youtube

Zero Coupon Bond Value Formula With Calculator

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

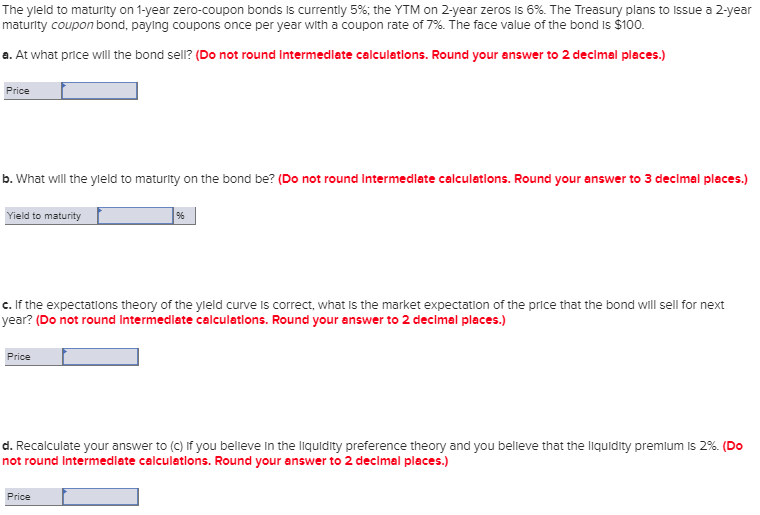

The Yield To Maturity Ytm On 1 Year Zero Coupon Bonds Is 4 And The Ytm On 2 Year Homeworklib

Q Tbn And9gcs8pllmjk Cwco2cxddqmohomgedhyw Veiacyoq Lypi38bu2o Usqp Cau

How To Calculate Pv Of A Different Bond Type With Excel

Berk Chapter 8 Valuing Bonds

Http Kevinx Chiu Weebly Com Uploads 8 9 8 3 380 Homework 3 Solutions Pdf

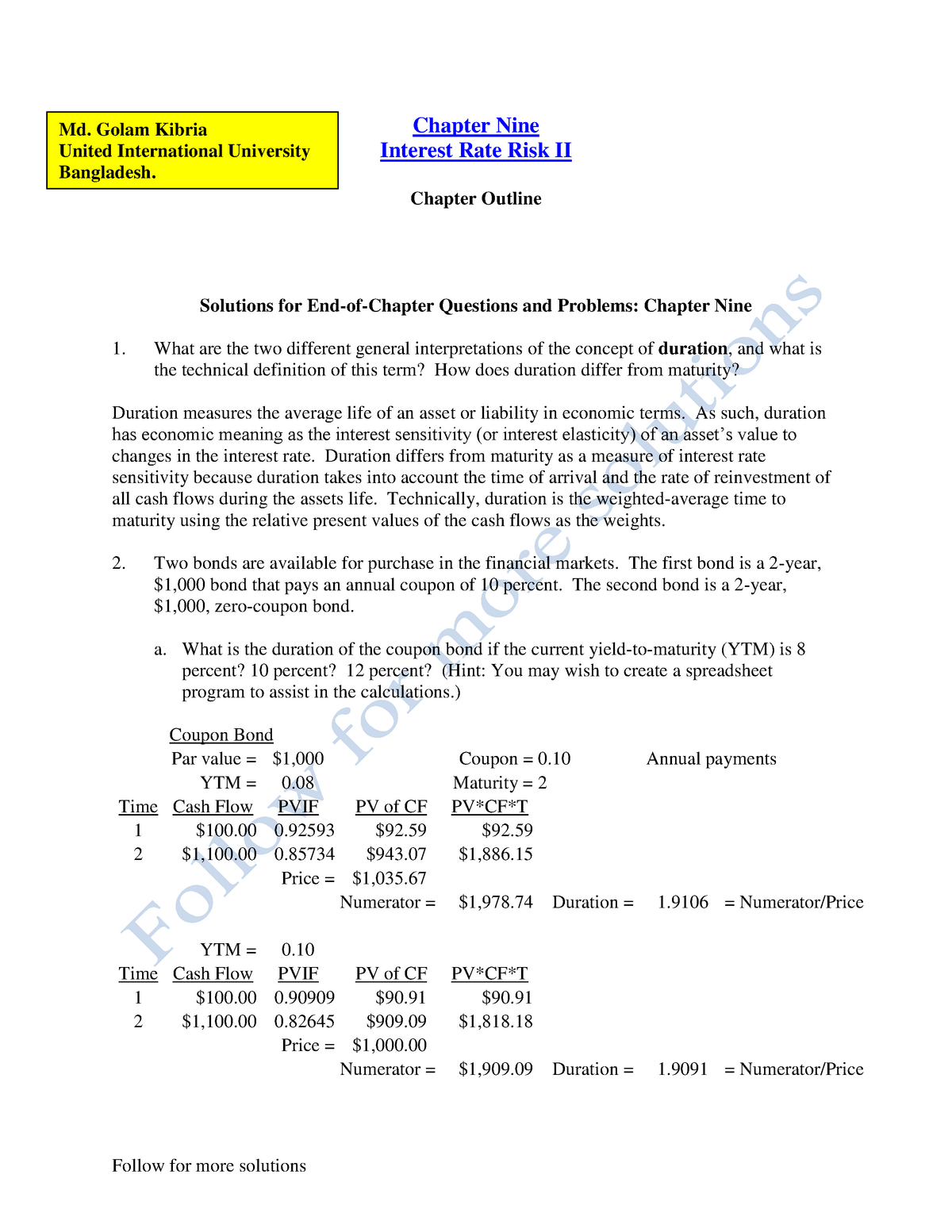

Chap009 Duration Gap Model Studocu

Yield To Maturity Ytm Definition Formula And Example

Duration Understanding The Relationship Between Bond Prices And Interest Rates Fidelity

What Is Yield To Maturity How To Calculate It Scripbox

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Current Yield Meaning Importance Formula And More

Solved The Maturities And Prices Of Zero Coupon Bonds Are Chegg Com

Valuing Securities Stocks And Bonds Bond Cash Flows Prices And Yields Bond Terminology Face Value Notional Amount Used To Compute The Interest Coupon Ppt Download

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Par Yield Curve Definition

The Yield To Maturity On 1 Year Zero Coupon Bonds Is Currently 6 5 The Ytm On 2 Year Zeros Homeworklib

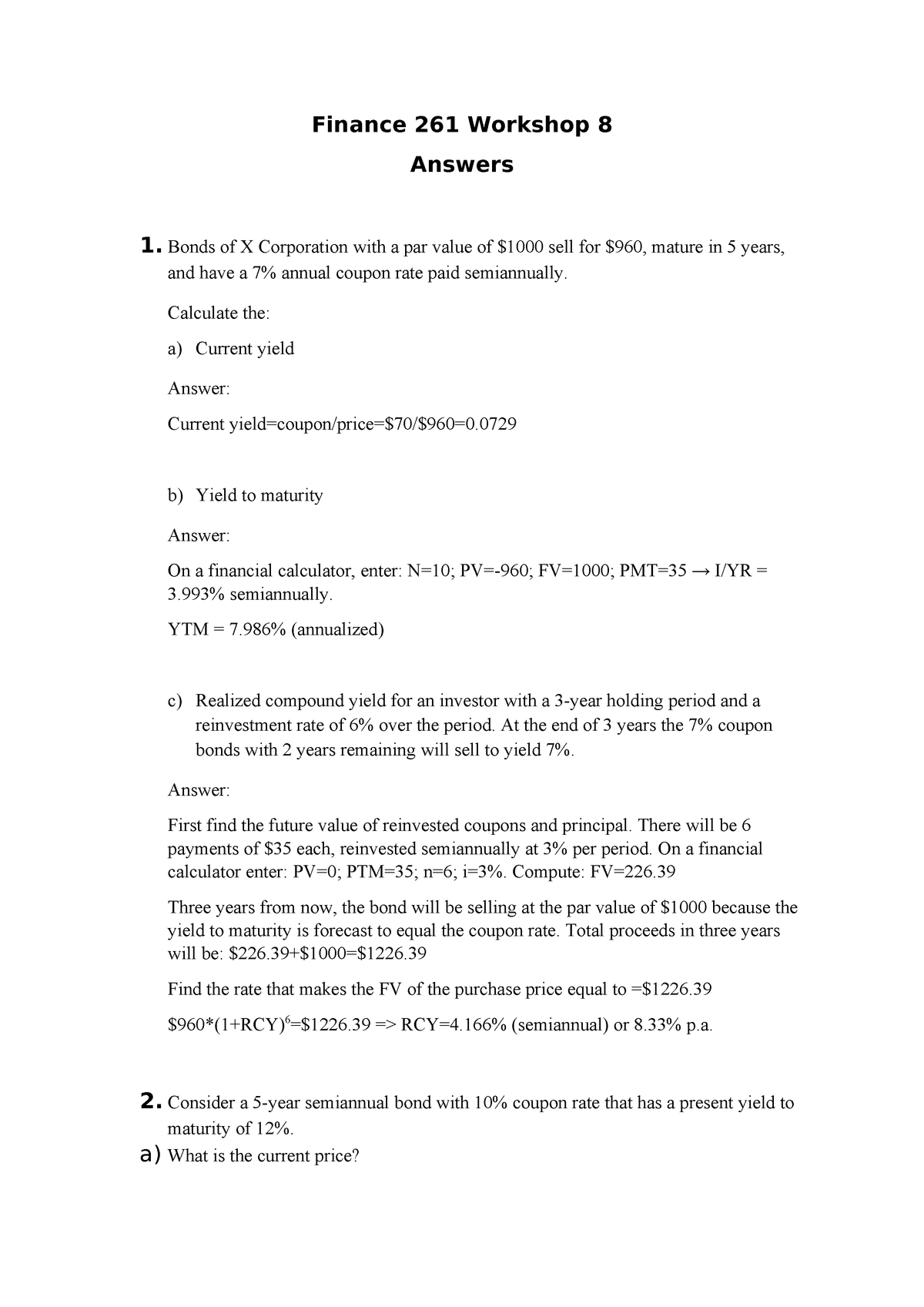

Workshop 8 Answers Finance 261 Fin261 Studocu

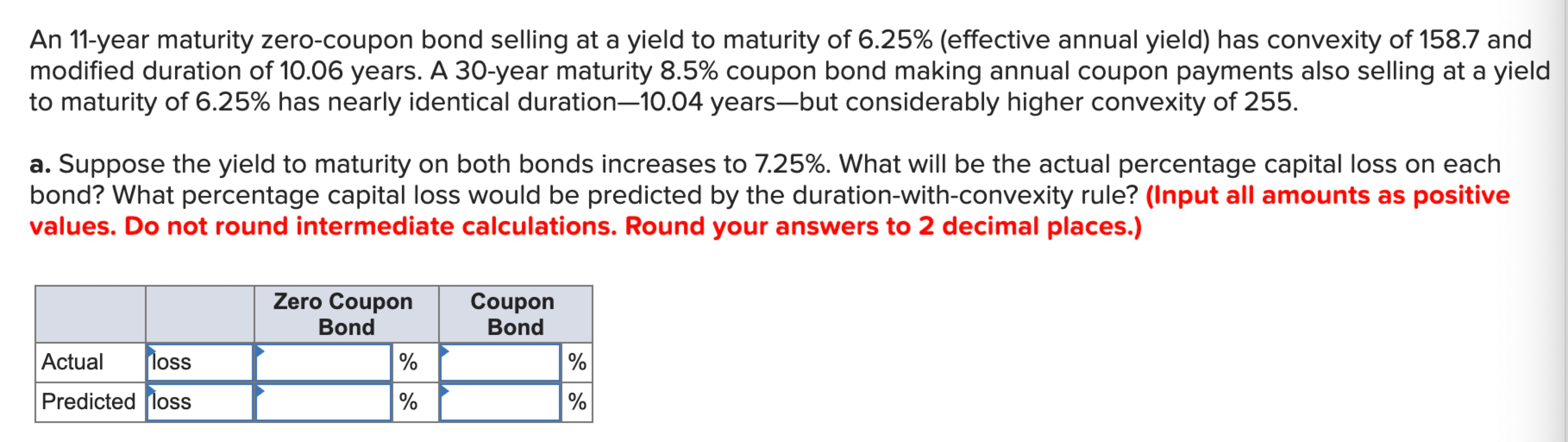

Solved An 11 Year Maturity Zero Coupon Bond Selling At A Chegg Com

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Calculating The Yield Of A Coupon Bond Using Excel Youtube

Vba To Calculate Yield To Maturity Of A Bond

Yield To Maturity Fixed Income

Yield To Maturity Ytm Overview Formula And Importance

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Berk Chapter 8 Valuing Bonds

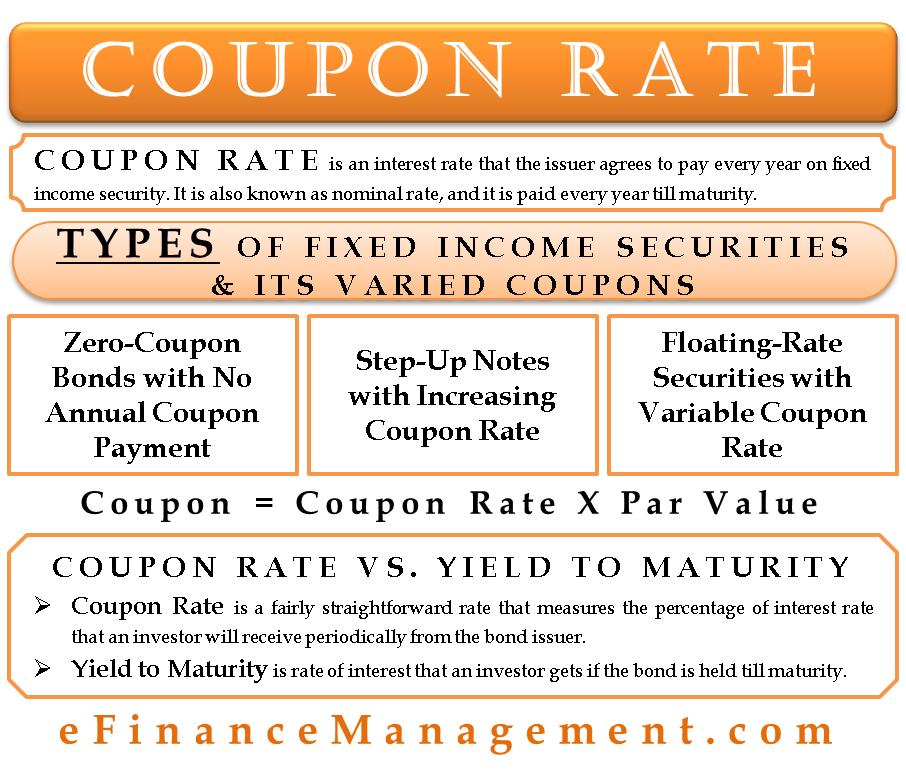

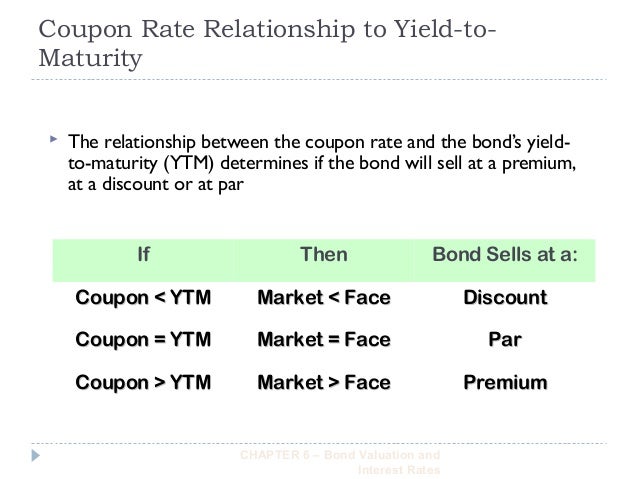

Coupon Rate Meaning Example Types Yield To Maturity Comparision

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

Bond Valuation

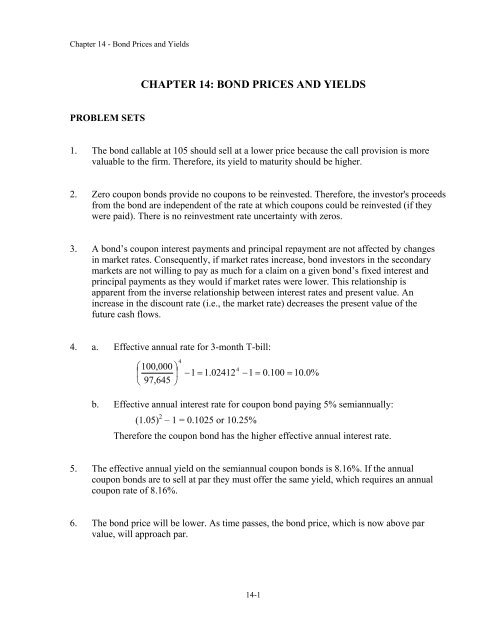

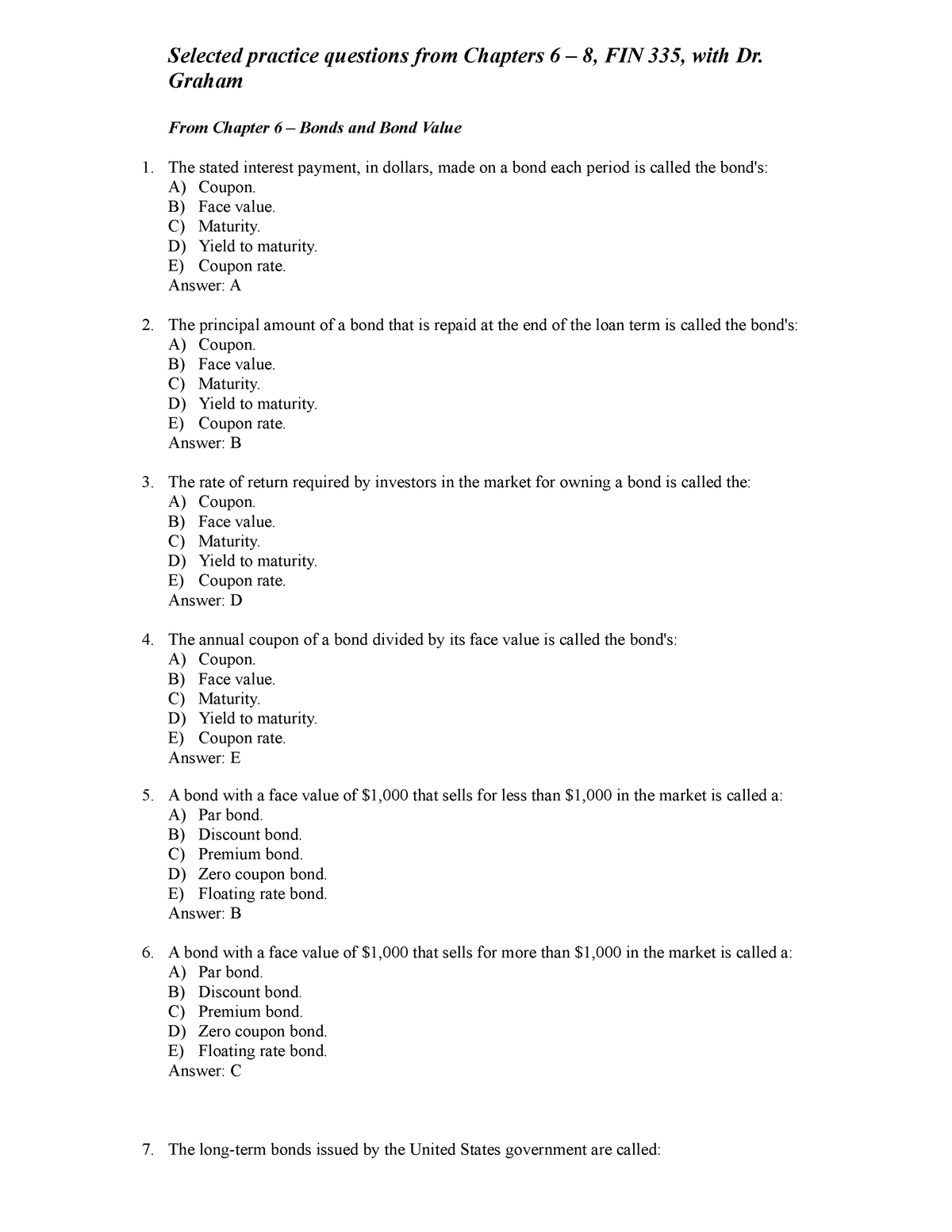

Chapter 14 Bond Prices And Yields To Maturity

How To Calculate Yield To Maturity In Excel With Template Exceldemy

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Www Iseg Ulisboa Pt Aquila Getfile Do Method Getfile Fileid

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

21 Cfa Level I Exam Cfa Study Preparation

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Coupon Rate Vs Yield Rate For Bonds Wall Street Oasis

Learn To Calculate Yield To Maturity In Ms Excel

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Homework 2 As Stated Before Studocu

2

Yield To Maturity Ytm Calculator

Exam Questions Financial Management Mad03 Studocu

Slides Show

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Duration And Convexity To Measure Bond Risk

The Yield To Maturity On One Year Zero Coupon Bonds Is 8 2 The Yield To Maturity On Two Year Zero Coupon Bonds Is 9 2 A What Is The Forward Rate Of Interest For The Second Year

Lecture 7 Measuring Interest Rate Ppt Video Online Download

Calculate The Ytm Of A Coupon Bond Youtube

Bonds Yields And Yield To Maturity Economics Online

Bond Valuation

Yields To Maturity On Zero Coupon Ronds Bond Math

Chapter 6 Bonds Ppt Download

The Yield To Maturity On 1 Year Zero Coupon Bonds Is Currently 4 5 The Ytm On 2 Year Zeros Homeworklib

Ch7

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

Coupon Vs Yield

Solving For A Bond S Yield To Maturity With Semiannual Interest Payments Youtube

Yield To Maturity Ytm Overview Formula And Importance

Zero Coupon Bond Definition Formula Examples Calculations

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Yield To Maturity Formula Step By Step Calculation With Examples

Finding Ytm Of A Zero Coupon Bond 6 2 1 Youtube

Valuing Securities Stocks And Bonds Ppt Video Online Download

Solved The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com

コメント

コメントを投稿